The nation’s leading financial advisors are looking to turn a profit — and they’re eyeing the fracking industry as one that’s sure to deliver hefty returns.

According to Chen Lin, an investment strategist, fracking is the new frontier for those looking to cash in on the stock market, as projections put the industry at the forefront of the U.S. quest for energy independence.

When asked by the Energy Report what his international prospects are for drilling in 2014, Lin said there was no reason to look outside of North America, citing the growing oil and gas industry of the U.S. and Canada.

“I think the major action is in the U.S. and Canada. The whole fracking revolution is picking up steam. We could see as much as a 1 million barrel per day increase in North American oil production! The United States is finally inching closer to energy independence, which could have a profound impact on the world,” he said

According to the International Energy Agency, the U.S. is on track to become the world’s top oil exporter by 2020, a projection investors are taking note of.

An article published in the Journal of International Energy Agency states:

“Five years ago no one would have been talking about the prospect of US energy independence. But this year, domestic crude oil production should rise by 10%, and within five years the United States is likely to break the record output high reached more than two decades ago, to flirt with the position of top world produce.”

It’s not yet a clear landslide victory for the oil and gas industry, but it’s close. The controversial method of injecting a combination of water, silica sand and carcinogenic chemicals into the earth to access previously unattainable oil and natural gas deposits is still facing legal roadblocks.

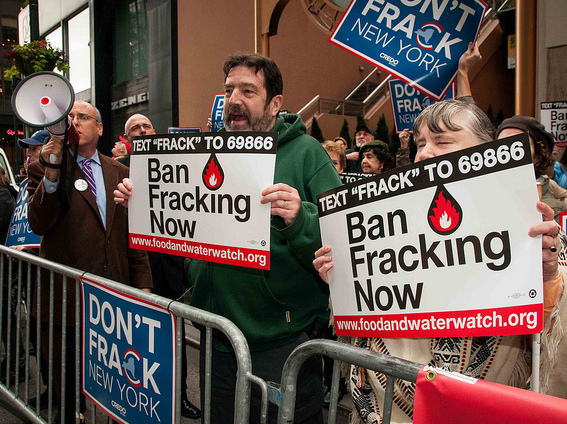

In New York alone — the only state with a statewide moratorium — more than 160 local municipalities have taken measures to ban fracking, and they’re not alone. In Colorado, which is emerging as a key state for the fracking industry, cities are attempting to stand up against the movement. In November, residents of Boulder and Fort Collins instituted a five-year moratorium on fracking. Lafayette, Colo. issued an outright ban.

These are the types of movements the industry will have to conquer in order to deliver a return for its investors — and it seems as though it’s willing to do whatever it takes to make that happen.

Too big to lose

In an interview with National Geographic, Colorado anti-fracking advocate Russell Mendell said the votes in favor of moratoriums in some of the state’s most influential communities had to do with real concerns associated with the health and environmental consequences of fracking.

“This is the point in history where communities need to decide if they want to stay addicted to hydrocarbons and fossil fuels or move toward sustainable energy,” Mendell told National Geographic, claiming he expects the moratorium trend to spread throughout the state.

That would be devastating for the industry, which is eyeing Colorado’s Niobrara Formation and its oil and gas deposits.

In February, facing growing city-instituted challenges to the fracking industry, Gov. John Hickenlooper (D) warned that the state would file lawsuits against local municipalities for instituting bans, claiming it restricted statewide laws relating to mineral rights.

Yet those warnings from Hickenlooper, who has appeared in pro-industry advertising campaigns, haven’t stopped Colorado communities.

Now the industry is taking matters into its own hands. Following the referendum defeat this month in Colorado, Noble Energy senior vice president Ted Brown indicated that his company and others within the industry would have to step up their game.

“We have a lot more work to do informing the general public,” he told the Wall Street Journal. “Quite frankly, that void has been filled for quite some time without a response from the oil and gas industry.”

Trust is now the name of the game. While the industry repeatedly refers to the fracking method as safe and free from environmental and health consequences, those living in the midst of the fracking boom in Pennsylvania and Colorado say otherwise.

In May, a fracking well malfunctioned in a rural Pennsylvania farming community, sending more than 9,000 gallons of chemical-laden fracking fluid onto nearby property and causing the evacuation of nearby residents.

Cases like this aren’t isolated. Reports have also shown groundwater contamination near fracking wells in Pennsylvania. A Duke University reported released in June indicated that homeowners living near fracking well pads in Pennsylvania were at risk for drinking contaminated water.

Using more than 140 residential drinking water samples, the study found that, on average, methane concentrations were six time higher, while ethane concentrations were 23 times higher at homes located within a kilometer from fracking well pads.

Despite the studies, spills and firsthand reports, the industry has repeatedly claimed fracking is safe, both in terms of health and the environment. The Environmental Protection Agency is set to release its study on the industry by 2016. A preliminary report released this year on that very study indicated that, at this point, no cases of groundwater contamination had been discovered.

For the industry, a final report containing a similar finding could be groundbreaking not only for oil and gas companies, but also their investors.

Despite real concern, confidence remains

Despite these concerns, those who specialize in investments claim the fracking industry is where it’s at.

That might be good news for those who stand to gain from the expansion of the industry, yet for those battling against a publically traded giant, it’s not.

Lin admits investing in fracking hasn’t been the best move in the last few years, but indicates that with bigger corporations jumping into the game with more efficient technology, now is the time to buy.

“The fracking technology has improved,” Lin said in his interview with Energy Report. “Most companies know how to drill a well cost-effectively and to get the most production out. As technological development is ongoing, a lot of questions have been answered. Infrastructure started building up. We see there are some pipelines at least in the lower part of United States already built up. Finally, large companies and Asian countries are starting to buy into the fracking play, paying as much as $60,000 per acre. That was a record.”

Even MSN Money is hopping on the fracking investment wagon, publishing a piece this year about the top 5 fracking stocks “made in America.”

“The gold rush — the hydrocarbon rush, the fracking rush — is on,” an article penned by “Traders Reserve” stated in a recent MSN Money article. “And opportunities for investors are immediate — and many.”